We're always here to help

Create YourFinancial FutureWith Us

We provide Businesses & Individuals with a secure financial system to spend, save and lend with Umba.

For Individuals

Lend money, grow your wealth & make payments with Umba

Savings

Earn up to 20% interest per annum when you save with us.

Logbook car loans

Loans up to 70% of your car's value and get instant cash within 6 hours.

Asset backed loans

Asset finance for those who need to finance the purchase of a vehicle.

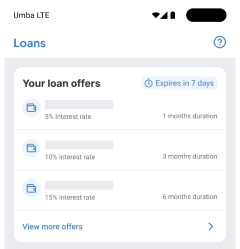

Instalment loans

Access loans for up to 12 months & pay in monthly instalments

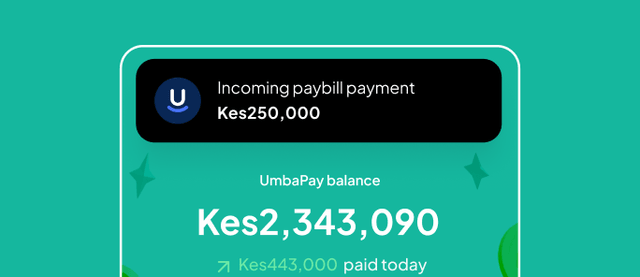

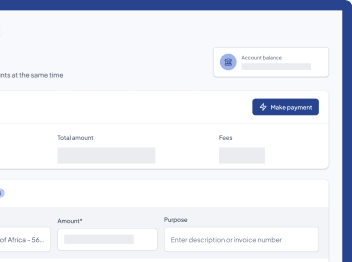

Payments

Fast payments to any Bank and Mpesa

International VAN

Get paid from anywhere in the world with your unique VAN

For Business

We provide you with an all-in-one account to bank & manage your teams.

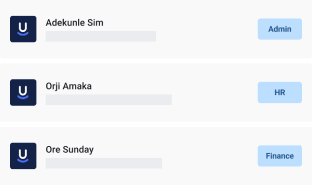

Sign up todayAccount management

Manage your business account as a team for seamless collaboration.

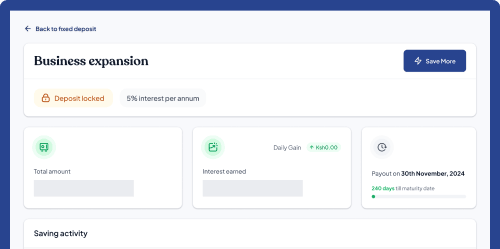

Fixed Deposits

Grow your money with attractive interest rates of up to 20% when you save with us.

Trusted by companies you

know & trust

Frequently Asked Questions

We answered some of your most asked questions

Umba is a digital bank operating in Kenya and Nigeria

Umba Business is a business solution centered around payroll and employee financing.

1. Savings account with interest rate 2. Cashback on bills payment 3. Salary allocation settings 4. Salary advance 5. Installment loans and lots more

An employee can request up to 50% of their net salary per month.

Employees can get up to 3x their net pay per month and pay back within 3-9 months

It is 5% interest rate for the salary advance & 5% per month for the installment loans.

The lending relationship always resides between Umba and the lender. If the lender left the business it would be up to the lender to repay the Umba facility through an alternative payment method and schedule agreed by Umba and the lender.

Yes a pay slip will be automatically generated by the system and sent to the employee.

Employees can choose where they want to get paid whether Umba accounts or non-Umba accounts. However, they need Umba accounts to enjoy the benefits available with Umba.

Our customer Customer Experience team are always on hand to assist with any issues

Still have questions?

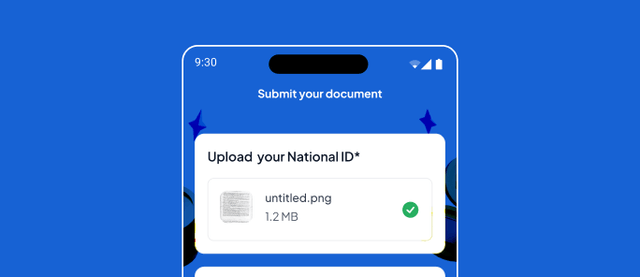

Contact SupportApply in three simple steps

Get started with your application today. Our streamlined process makes it quick and easy.

Fill the application form

Provide your details and loan requirements in our simple online form.

Customer representative calls

We verify your details and discuss the best options for you.

Loan disbursed

Receive funds quickly once approved, directly to your account.